- This event has passed.

National Immersion Program – NISM

March 11 @ 8:00 am - March 13 @ 5:00 pm

Students from II B. Com, II BBA, and II BBA(IB) embarked on an exciting journey at the NISM Immersion Program from 11/03/2025 to 13/03/2025.

Day 1 Highlights (11/03/2025):

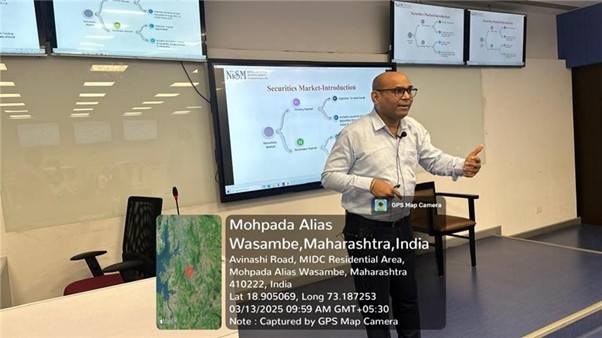

The day’s proceedings kicked off with an insightful session on ‘Introduction to Securities Markets’ by Dr. Shreyas Vyas, Assistant Professor, NISM. Dr. Vyas delved into the nuances of the stock market, key regulatory frameworks including the SEBI Act, Depositories Act 1996, and the role of the Securities Appellate Tribunal. He also discussed the functioning of prominent exchanges like MCX.

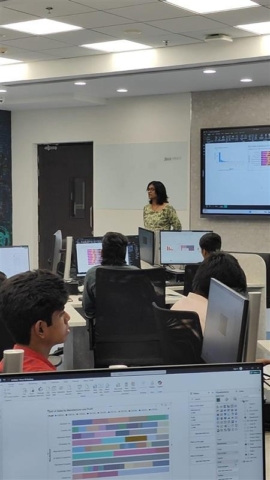

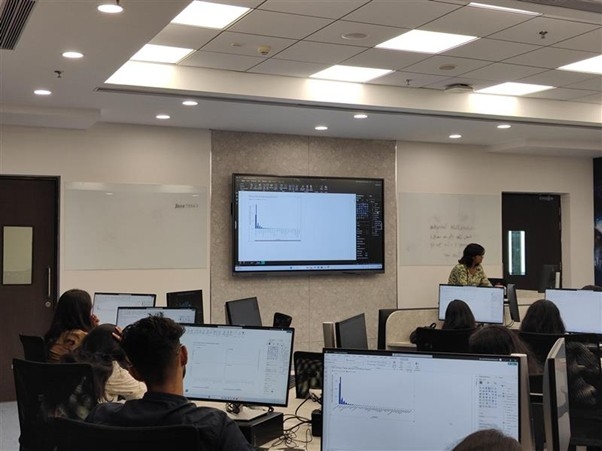

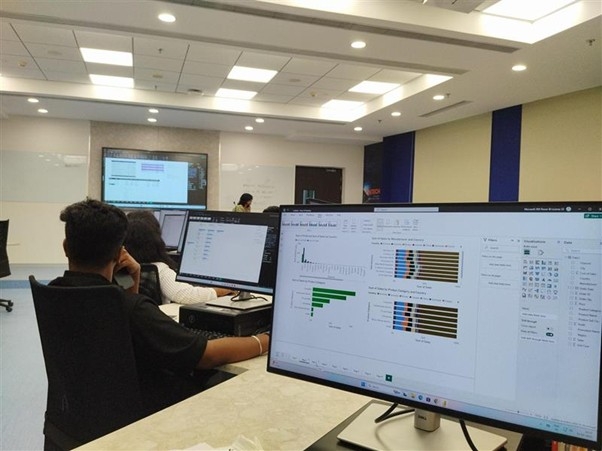

The afternoon session featured ‘The Ultimate Power BI Overview’ by Dr. Kirti Arekar, Professor at NISM, followed by hands-on training in the Data Science Lab. Students learned about Power BI’s basics, features, components and created interactive dashboards using sample sales data. They gained practical experience in data visualization, reporting, publishing and equipping them with the skills to leverage Power BI for data-driven decision-making and business intelligence.

Day 2 Highlights (12/03/2025)

The second day of the NISM Immersion Program began with an enlightening session at the Multi Commodity Exchange (MCX), where Mr. Anish Vyas, Trainer at MCX, delivered an engaging and informative presentation. He provided a comprehensive overview of financial markets, MCX’s role, market structure, types of commodity markets, and regulatory frameworks governing them. Mr. Vyas also explained various contract types through real-life scenarios, discussed factors influencing commodity prices, and offered a comparative analysis of commodity and equity markets. Furthermore, he shared essential do’s and don’ts for investors, and introduced the students to the SEBI New Investor website and the Saarthi app, empowering them with valuable insights into the commodity markets and informed investment decisions.

Day 3

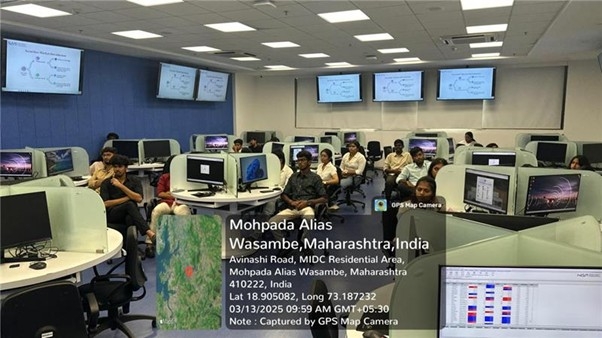

The third day of the NISM Immersion Program featured an engaging session on ‘An Overview of Securities Market’ held at the Simulation Lab, led by Mr. Sanket Ahire, Deputy Manager at NISM. The session provided a comprehensive understanding of the securities market, covering key aspects such as various investment avenues, market infrastructure institutions, and the different products traded in the market, including equities and derivatives. Participants also gained valuable insights into the functioning of the Over-the-Counter (OTC) market.

A major highlight of the session was the hands-on training on trading simulations. Students actively participated in placing orders, buying and selling securities, and managing pending orders. This practical exposure helped them better understand real-time trading scenarios, enhance their decision-making abilities, and develop essential skills required for navigating the securities market effectively.

The second session was handled by Dr. Jatin Trivedi, Program Director at NISM, Mumbai. He spoke about behavioural finance and how emotions and psychology influence investment decisions. He shared interesting case studies such as the Harshad Mehta Scam, the Nick Leeson–Barings Bank case, and Isaac Newton’s experience with share investments. While discussing the Barings Bank case, he explained how a single trader, Nick Leeson, caused the collapse of one of the oldest banks in England through unauthorized trading and poor risk management. Dr. Trivedi also explained the basics of IPOs, making the session informative and engaging.